Introduction:

Tax filing season can be a daunting time for many individuals, with questions ranging from the basics of filing to more complex issues. This comprehensive guide aims to address commonly asked questions about tax filing, providing clarity and guidance to help you navigate the process with confidence.

I. Understanding the Basics:

What is Tax Filing?

Explanation of the concept of tax filing.

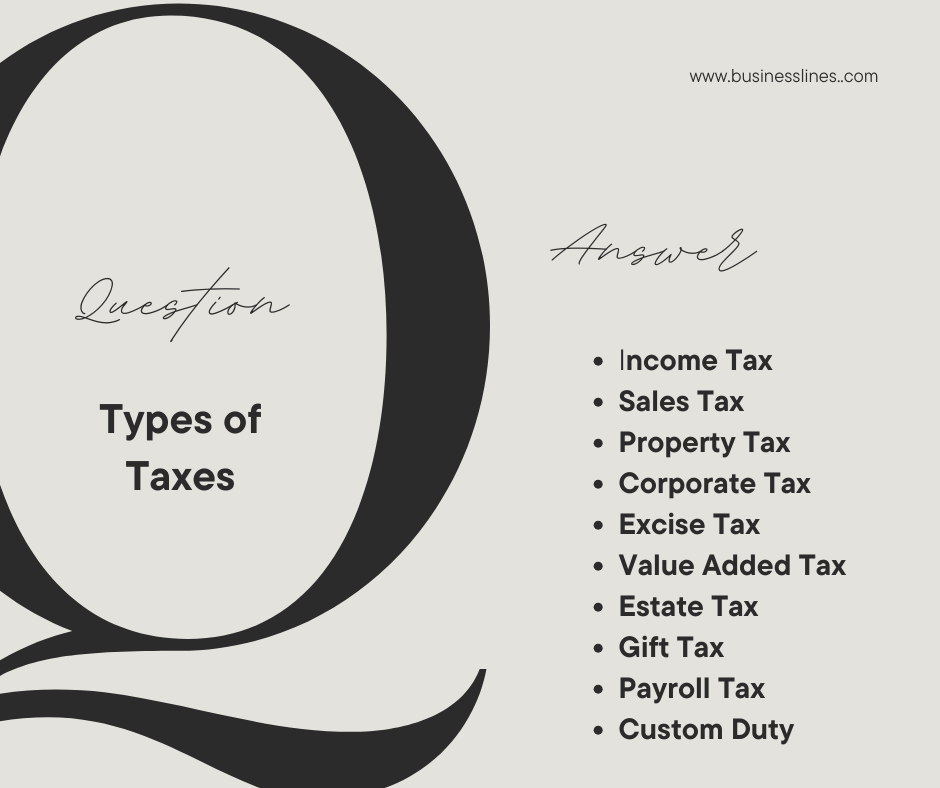

Different types of taxes (income tax, property tax, etc.).

Who needs to file taxes?

When is the Tax Filing Deadline?

Overview of the tax calendar.

Penalties for late filing.

How Do I Determine My Filing Status?

Explanation of filing statuses (single, married filing jointly, head of household, etc.).

How to choose the right filing status.

What Documents Do I Need to File Taxes?

List of essential documents (W-2, 1099, receipts, etc.).

Importance of accurate record-keeping.

II. Income and Deductions:

What Qualifies as Taxable Income?

Overview of different types of income.

Common sources of taxable income.

Are Gifts Taxable?

Understanding the gift tax.

Exclusions and reporting requirements.

What Deductions Can I Claim?

Overview of common deductions (standard deduction, itemized deductions). Maximizing deductions for homeowners, students, and self-employed individuals

Can I Deduct Work-Related Expenses?

Eligible work-related expenses.

Keeping track of expenses and receipts.

III. Tax Credits: What Are Tax Credits?

Definition and purpose of tax credits.

Examples of common tax credits (Child Tax Credit, Earned Income Tax Credit).

How Do Education Credits Work?

Overview of education-related tax credits (American Opportunity Credit, Lifetime Learning Credit).

Qualifying education expenses.

IV. Special Situations:

What if I Worked in Multiple States?

Understanding state taxes.

Filing requirements for multiple-state income.

Do I Need to File if I’m Self-Employed?

Self-employment tax.

Quarterly tax payments and deductions for the self-employed.

How Does Marriage Affect Taxes?

Tax implications of getting married.

Filing jointly vs. separately.

What Happens if I Can’t Pay My Taxes?

Options for those who can’t pay in full.

Setting up a payment plan.

V. Tax Software and Professional Help:

Is Using Tax Software Safe?

Benefits and risks of using tax software.

Popular tax preparation software options.

When Should I Hire a Tax Professional?

Signs that you may need professional assistance.

Choosing the right tax professional.

Conclusion:

In conclusion, navigating the complexities of tax filing becomes more manageable when armed with knowledge. This comprehensive guide has addressed commonly asked questions about tax filing, empowering individuals to approach the tax season with confidence and ensuring compliance with tax regulations. Remember, staying informed and seeking professional advice when needed are crucial steps in achieving a smooth tax filing experience.